Why are Market Makers and Liquidity Providers Important to the Markets?

Why are Market Makers and Liquidity Providers Important to the Markets?

The Forex market is a complex web of financial actors and institutions, each playing its own specific role in making the market work. Among these participants are market makers and liquidity providers. Though they share some similarities, their primary purposes are quite different. In this article, we will take a closer look at what these two entities are, how they work, and how they provide Forex liquidity solutions.

When most people think about exchanges, the first thing that comes to mind is market makers. Market makers are entities that provide quotes to traders wishing to open or close a position. The quotes they offer are also known as “Bids” and “Asks.” If someone wants to go long on an exchange, they will have to myfsapay program pilot the Ask price while the person selling will get the Bid price.

Market makers can be banks, brokerage companies, or any other type of financial institution. They typically have a lot of capital, which is why they can afford to take a position on an exchange. Market makers, unlike liquidity providers, do not have a specific goal of keeping the market stable; rather, their aim is to earn money.

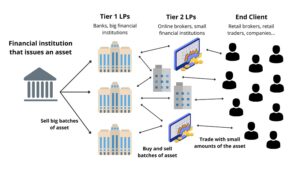

Liquidity providers in Forex are individuals or businesses who seek to provide liquidity to the market by stepping in when it is needed. Because of a lack of liquidity, traders will have a tougher time opening positions. By providing liquidity when necessary, these companies help maintain the markets’ smooth operation and facilitate trading. Thanks to them, we can all trade with confidence, knowing that our orders will be filled quickly and without issue.

Market Makers are in the business of making a profit from the spread. No matter how many positions they have, what matters is the profitability they can get from them in a certain period of time. Their behavior pattern can be difficult to predict, making it tough for an average trader to try and anticipate their next move. FX liquidity providers are there when traders need them most, providing liquidity by jumping in when needed so that no one would be left without any opportunities because of lack of liquidity. By being proactive in this way, liquidity providers help keep the markets liquid and, therefore, more efficient. This is a valuable service that benefits all traders, including those who don’t use liquidity providers directly.

Market makers are available to provide prices or quotes to anyone interested in the market. They don’t have a set spot on the market, and their major goal is to profit from the spread rather than to be there at different times. As previously said, they alter their behavior in response to various circumstances, making it difficult for an average trader to predict their next move.

This can make it difficult for traders to know when and where to enter or exit a trade. However, by understanding how Market Makers work, traders can arm themselves with the knowledge they need to make more informed decisions.

Liquidity providers provide a valuable service to traders by helping them open and close positions. While their main goal is not to profit from the spread, they do earn commissions and interest rates for providing this service. This makes Forex liquidity providers important for traders looking to execute orders quickly and efficiently.

Market makers work for brokerages. They generate revenue by charging commissions on every transaction their clients make through the brokerage account. The primary goal is to make money. However, this will be strongly influenced by the number of transactions in the market at any given time, as commissions are calculated based on the number of transactions rather than the entire value of these trades. This is an important job because it helps keep the markets running smoothly and efficiently.

Liquidity providers are companies that act as counterparties for large organizations/banks/central banks who want to open positions in the market. They charge commissions for their services, which are taken from every trade made with them by the organization they represent. This commission is based on the number of transactions, and it does not depend significantly on how large a position is opened. In addition, this commission is usually much lower than other commissions involved when opening a position. This is because larger organizations generally have much better conditions when dealing with liquidity providers.

In conclusion, market makers and liquidity providers try to enhance market conditions by increasing activity and offering a more favorable trading environment. They both have tactics, however, that regular traders are unable to control or forecast. To take advantage of this knowledge and avoid being left behind, you must first understand how these entities work.